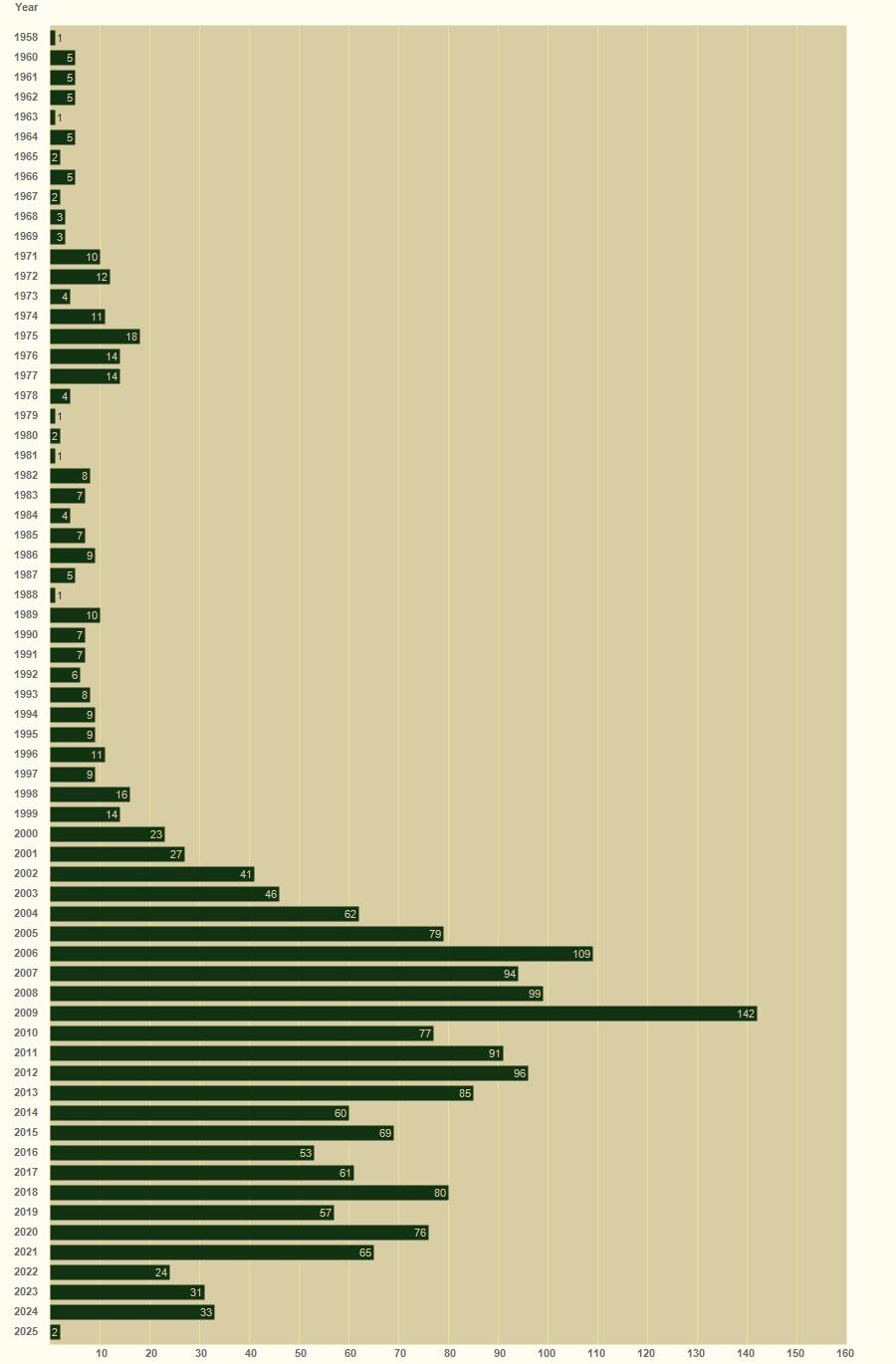

It is often said that this hobby is currently going through a 'Golden Age', with new sets appearing all the time and a record number of manufacturers satisfying demand. So we thought it would be interesting to actually quantify that, and let the statistics show just how the hobby has fared over the few decades that it has existed.

Below is a breakdown of the number of sets released each year. The figures are taken from the reviews to be found on this site, which we believe to represent all the important sets ever produced. At certain times both in the past and today, poor quality figures, usually copies, have been produced by various manufacturers such as Giant. Since we do not include these on this site they are not part of these statistics. Also note that the statistics only include 'soft' plastic sets, not hard plastic or resin, and also exclude reissues such as those from Nexus or Italeri.

During the 1960s, Airfix were the only major producer, but released three or four sets a year. In 1972, Atlantic came on the scene, producing many sets, and in 1976 Matchbox also began their range, causing the peak we see during the seventies. By the end of the 1970s the market was in serious decline, with the last new Atlantic figure set in 1978 and both Airfix and Matchbox slowing down - both had made their last set by 1983. Luckily Esci began producing their first soft plastic set in 1982, and are solely responsible for virtually all production during the 1980s, maintaining a pretty steady rate. Esci production stopped suddenly in 1989, but again a new company was to come along to keep things going - this time it was Revell. They produced around six sets a year for the first few years, and were joined by Accurate in 1991 and IMEX in 1993, both producing small quantities each year. In 1995 Italeri started making sets in small numbers, and the following year HaT released their first set. All these companies continued to produce new sets, with HaT quickly getting into their stride and outstripping all their competitors. As a result, we see production levels rising significantly in the late 1990s.

By 2000 Revell were losing interest, but Italeri, HaT and the others were in full flow, and A Call To Arms had starting to produce scaled down versions of their 1/35 range. The new century also saw debut sets from Emhar and Zvezda, but it was Italeri and HaT that were really pushing things now. 2001 witnessed the first sets from Orion and Strelets, and the East European surge grew in 2002 with sets from LW and MiniArt as well as the Italian producer Waterloo 1815. 2003 welcomed Dark Dream Studio and Lucky Toys while 2004 saw the first original figures from BUM and new output from Caesar Miniatures, Armourfast and Pegasus. 2005 continued to see real growth, with ever more companies joining the rush to make more and more figures.

2006 saw the hobby reach a peak of production, with over 100 brand new sets appearing. However manufacturers began reporting a drop in sales, partly because of a slowdown in the world economy and partly simply because the market could not afford so many new sets. Profit margins shrunk dramatically and several manufacturers have scaled down or even suspended output in favour of more profitable lines.

2007 saw a small drop in output overall as the market rebalanced towards a sustainable level.

2008 and 2009 was a time of dramatic economic difficulties worldwide, and with many economies going into recession this seemed likely to impact on the amount spent on buying new figure output. However while sales stopped growing and manufacturers reported poorer returns on each set, the number of sets produced continued to rise, with over 140 new sets in 2009. Overall spending on hobbies such as this had not been greatly effected by the economic difficulties, but the large number of new products inevitably put pressure on numbers of each set sold, and most of any particular set were sold within the first three months of release.

The years 2010 to 2013 saw something of a 'readjustment' after the frantic output of 2009, but output remained high. Each year saw over 75 brand new plastic sets, with the major contributors both in terms of diversity and numbers of products being HaT, Strelets, Caesar and Zvezda (although the last was only making their small game sets by this period). However a growing number of smaller producers also added their weight to the range, including more from Eastern Europe like RedBox and Mars, and some of these producers introduced some very exotic and unusual subjects to further widen the scope of the hobby.

The volume of new sets was, however, declining, and this became more apparent in 2014, which saw less than half the number of new releases in 2009. HaT and Mars made the most additions to their catalogue in this year, but there was little new product from past high-volume companies like Strelets and Caesar, and with companies like Zvezda and Italeri virtually leaving the market 2014 was the quietest year for a decade. This may have been partly down to economic woes in some parts of the world, but it must also be recognised that by this stage so many different subjects had been made that it was hard to think of new subjects that would prove popular enough to make a return on investment.

The following few years saw the market settle, with generally between 50 and 60 sets being made each year by companies like Mars, RedBox, Ultima Ratio and Strelets, marking the dominance of producers from Ukraine, although First to Fight of Poland and Waterloo 1815 of Italy also made their contributions. Hat, now Chinese, made a very small number of new sets each year, and Taiwanese manufacturer Caesar were still making a handful, but this too would dry up in time. 2018 saw German company Linear-A really get going with their range, again made in Ukraine, and their subjects gave a real boost to fans of the ancient world.

2022 of course saw the start of the Russian invasion of Ukraine, which obviously had a severe effect on output from that country, and so greatly impacted the hobby. The first half of 2022 saw a dramatic reduction in output, and also an interruption in production of existing sets, so as with so much else, war has completely changed the environment, and the future is very uncertain.

At the time of writing the war in Ukraine continues, massively impacting the output of that country and making it impossible to predict the future. New product has become no more than a trickle, but naturally the course of the war, and its outcome, will have an enormous effect on the future of the hobby.

The ever more comprehensive coverage of human history was always likely to force manufacturers to either cover more marginal subjects or else repeat the output of others. RedBox and Strelets have introduced new campaigns and periods of history, which brings with it greater risks but also greater rewards, and the re-emergence of Caesar has again expanded the range of periods being covered, as has Linear-A. With the popular subjects of World War II, Napoleonics and Imperial Rome now so well covered, there must be a limit to how many new sets on a given theme that the market can stand, so new periods are vital to sustain growth, and also introduce a wider range of history to an international audience. In recent years we have seen more sets on civilian themes, and more airborne and naval subjects too. Such sets will always be welcome, but inevitably they may have less appeal in the wider market, such that larger manufacturers with higher costs may see them as not worth the risk. So the future of the hobby may well be with the smaller producers who can better control their costs and cater for the more specialist interests.

So the hobby has changed and matured a great deal over the past few decades, but the number of new sets has been consistently good over recent years, averaging more than one each week, which would have been unthinkable a generation ago. For the future however there is one technology that will have a massive impact - 3D printing. As this becomes gradually better and cheaper, we may see the end of manufacturing, replaced instead by the selling of patterns which the customer can download and use to print their own figures on their local printer. There are already many small producers who market their creations on the internet, and by avoiding the enormous costs of production and distribution, that may signal a new phase for the hobby with many small-scale designers finding it relatively easy to offer designs with few costs to recoup. However the cost of 3D printers remains high, so it seems unlikely that they will become normal equipment owned by enthusiasts for the time being, so this will likely remain a medium for small-scale producers for the foreseeable future.

This page is automatically updated each time a newly released set is recorded